[ad_1]

The financial crisis has had at least one interesting side effect: the rise of alternative and increasingly creative forms of financing. During the economic recession, and continuing to today, credit and other traditional forms of start up financing became more difficult to obtain. As a result, entrepreneurs began looking to newer, less-traditional forms of raising capital that cut out the financial intermediaries (banks, for instance) that are typically present in the process.

Peer-to-peer (also known as person-to-person or P2P) lending is a process of borrowing directly from individuals; in most instances, the lender and the borrower never meet. There are a variety of ways this happens, but generally, the process is relatively simple: The borrower registers on one of the many peer-to-peer web sites and is then matched up with a number of lenders who are interested in investing based on the borrower and the interest rate, among other things.

The P2P industry has been growing rapidly over the past few years: In 2005, there was $118 million in outstanding P2P loans; by 2011, that number had reached more than $500 million. P2P web sites make a profit by charging the borrowers an interest rate (usually 2 to 5 percent) on top of what the lenders require. The overall success rate of getting a loan through a P2P process is about 10 percent. Microfinancing has become more popular recently because new ventures are requiring less financing than in previous years.

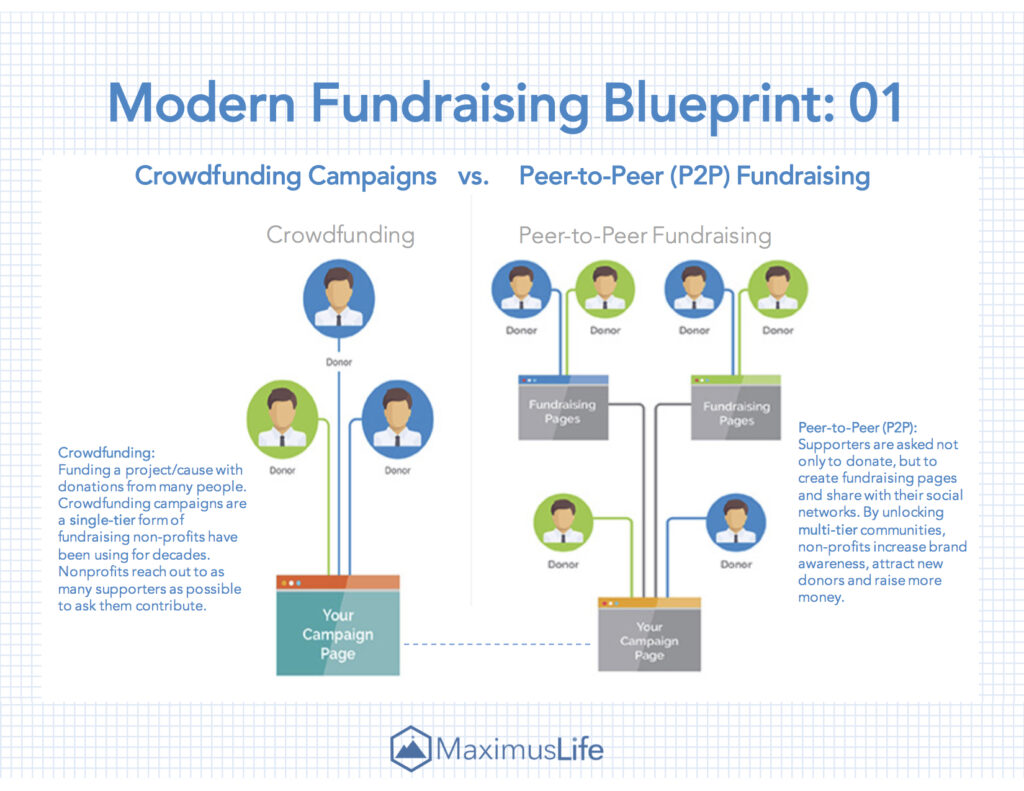

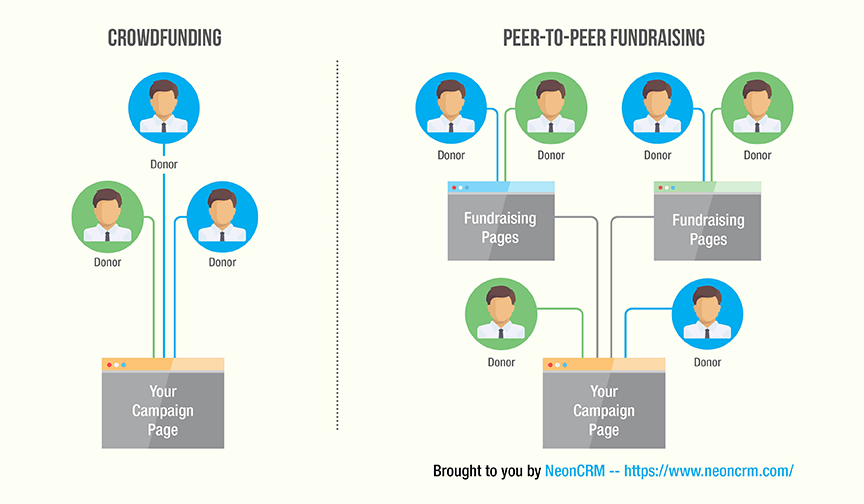

In the same vein, one creative funding source that has evolved in recent years is crowdfunding. Crowdfunding (or crowd financing), like P2P, involves getting individuals to pool their resources to finance a project without a typical financial intermediary. Unlike P2P, however, the lenders (also known as (“crowdfunders”) often do not engage in crowdfunding strictly for financial gain. In fact, the “lenders” often actually act more like donors. In a typical transaction, an entrepreneur can go onto a crowdfunding web site, propose the amount needed for the project, and, if the amount pledged is met crowdfunders, receive the funds. Usually, the crowdfunders receive something in return, like a product from the business (a DVD or CD from the film or album produced, for instance) but not their money back, if the project is funded, so the funds are not donations in the strict sense. In fact, studies show that for the majority of backers, the reward is the main motivator of their monetary pledge. Crowdfunding sites generally make a profit by taking a small percentage (about 5 percent) from the projects funded before the money goes to the entrepreneur.

[ad_2]

Source by Aidan Townsend